Published

2 years agoon

By

GHMediaHub

One of Hollywood’s oldest companies, Paramount Global, has agreed to merge with independent film studio Skydance Media.

Under the deal, Paramount’s non-executive chair Shari Redstone will sell her family’s controlling stake in the company in a complex transaction that will result in a new firm worth around $28bn (£21.9bn).

It marks the end of an era for the Redstone family, whose late patriarch, Sumner Redstone, transformed a chain of drive-in cinemas into a vast media empire.

As well as Paramount, the group includes the television networks CBS, Comedy Central, Nickelodeon and MTV.

“Our hope is that the Skydance transaction will enable Paramount’s continued success in this rapidly changing environment,” Ms Redstone said in a statement.

According to the company its TV channels have a global reach of over 4.3 billion subscribers across more than 180 countries.

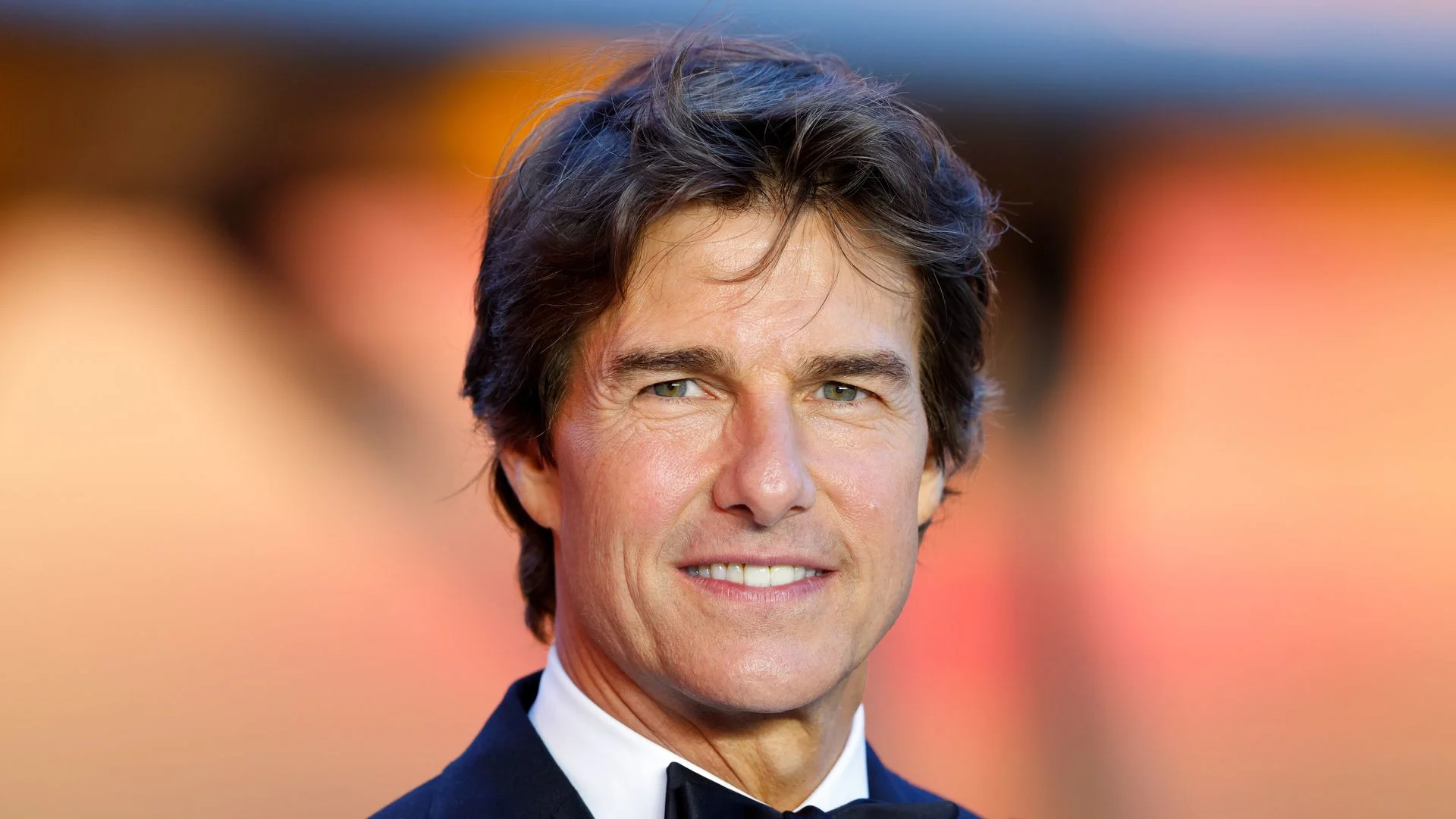

The merger would combine Paramount, home of classic films such as Chinatown and Breakfast at Tiffany’s, with its financial partner on several recent big releases, including Top Gun: Maverick and Star Trek Into Darkness.

Under the agreement, Skydance will invest around $8bn in Paramount, including paying $2.4bn for National Amusements, which controls the group.

National Amusements owns just 10% of Paramount Group’s shares but accounts for almost 80% of its voting rights.

Paramount said it expected to close the deal by the summer of next year.

Paramount Global traces its origins back more than a century to the founding of Paramount Pictures Corporation in 1914.

The studio has made many hit films, including the Godfather, Star Trek, and Mission: Impossible series.

But the entertainment giant has struggled over the past decade. Paramount Global’s shares have fallen by more than 75% in the last five years.

Skydance is owned by David Ellison, the son of Larry Ellison, who founded US technology giant Oracle.

The announcement came after eight months of negotiations that saw Redstone holding talks with a number of potential partners including Sony and private equity firm Apollo.

In April, Paramount’s chief executive Bob Bakish left the company after clashing with Ms Redstone over the planned Skydance deal.

The deal comes as the global entertainment industry is being transformed by the video-streaming revolution.

Source: CNR