Published

1 year agoon

By

GHMediaHub

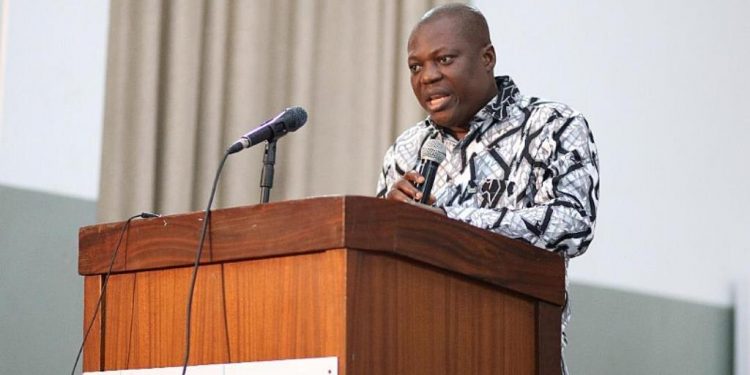

Professor John Gatsi, an Economics expert from the University of Cape Coast (UCC), has expressed skepticism regarding the effectiveness of the proposed tax amnesty by Vice President Dr. Mahamudu Bawumia, stating that it may not significantly improve tax payments or address underlying tax-related challenges.

Dr. Bawumia, the flagbearer of the New Patriotic Party, has pledged to introduce a tax amnesty and implement a simplified flat tax regime, aiming to create a more citizen- and business-friendly tax system if elected president. This proposed system would entail a flat tax based on a percentage of income for individuals and Small and Medium Enterprises (SMEs), with appropriate exemption thresholds to protect low-income earners.

However, Professor Gatsi argues that this measure fails to tackle the root cause of tax collection challenges in Ghana. He believes that the primary issue lies in citizens’ lack of commitment to voluntarily pay taxes, as they perceive no direct benefits from doing so.

In an interview , Professor Gatsi emphasized the importance of improving public services as a means to motivate tax compliance. He highlighted deficiencies in public infrastructure, such as inadequate public transport and limited access to public services, as factors contributing to citizens’ reluctance to pay taxes.

According to Professor Gatsi, addressing these underlying issues and enhancing the provision of public services would foster a greater sense of responsibility among citizens towards tax payment. He asserts that merely offering tax amnesty without addressing these fundamental concerns is unlikely to lead to significant changes in tax collection behavior.