Published

4 years agoon

He said a number of businesses and families had also suffered in the process, stressing: “I have felt the pain of customers caught in the engineered liquidity crisis.”

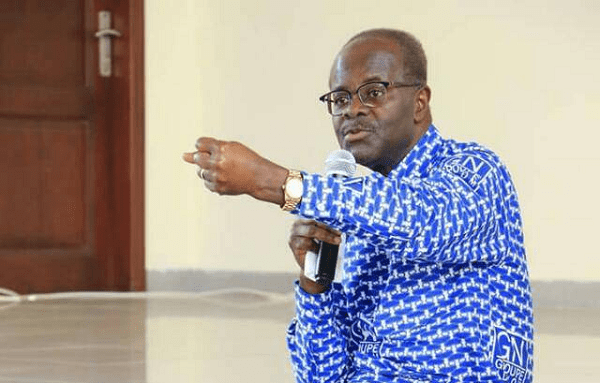

In an interview from his base in the United States of America exactly a year after the revocation of the licence of the GN Bank, which had downgraded to operate as a saving and loans company, Dr Nduom said he had “an unshakable belief that while there is judgment here on earth, we will all have to give account to the Higher Judge above one day. What is covered by darkness, documents hidden, plans hatched behind closed doors to make others suffer will come to light”.

Context

On August 16, last year, the Bank of Ghana (BoG) revoked the licences of 23 savings and loans companies and finance houses, citing insolvency.

The affected institutions included Ideal Finance, GN Savings and Loans, First Allied Savings and Loans, ASN Financial Services, Midland Savings and Loans, IFS Financial Services, uniCredit Savings and Loans and Women’s World Banking Savings and Loans.

According to the BoG, GN Savings and Loans, despite its reclassification from a universal bank to a savings and loans company in January 2019, was unable to resolve its liquidity issues.

A statement issued by the BoG said the revocation of the licences of the institutions had become necessary because they were insolvent, even after a reasonable period within which the bank had engaged with them in the hope that they would be recapitalised by their shareholders to return them to solvency.

“These actions were taken pursuant to Section 123 (1) of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930), which requires the Bank of Ghana to revoke the licence of a bank or specialised deposit-taking institution (SDI) where the Bank of Ghana determines that the institution is insolvent,” it said.

The BoG also appointed Eric Nipah as the Receiver for the specified institutions, in line with Section 123 (2) of Act 930.

Following the collapse of GN Savings and Loans, Dr Nduom challenged the BoG’s decision in court, with the case still pending.

Day of pain

Dr Nduom said August 16, 2019 would stay in his mind as “a day of infamy, treachery and robbery of the rights and assets of indigenous Ghanaian entrepreneurship”.

He said for one year, he had taken numerous opportunities to state the case of GN Savings in public.

“I have sent numerous petitions to state and traditional authorities. I took the advice of many of them to appeal to the Human Rights Division of the High Court in Ghana to seek the restoration of the rights which were wrongfully taken away from me on that day by the BoG. While the matter is still in court, I will continue to stay away from the substantive matter,” he stated.

Aspersions

Dr Nduom wondered why some politicians were so eager to take a matter in court, ignore the fact of the existence of due process, and go on television, radio and social media and cast aspersions on shareholders and directors of the affected companies.

“Why are many Ghanaians so quick to rejoice and are willing to inflict more damage when they perceive that someone is down?” he asked.

Deep thoughts

He said nobody gifted a banking licence to him and the other shareholders, saying they worked very hard to get a licence from the BoG to establish the First National Savings and Loans Company Limited, which became GN Bank.

He said GN Bank then became GN Savings & Loans Company Limited, following the approval by the BoG to reclassify the bank.

Process

Dr Nduom said the shareholders started the process to create a national financial institution in 1997, saying after nine years of planning, preparation and interactions with the BoG, First National was granted a licence to open for business in May 2006.

“A number of local companies and people were rejected as potential shareholders. Eventually, our company, Coconut Grove Hotels, became the major shareholder, later to be joined by others. The required capital was paid in and verified by the BoG,” he recalled.

He said the company started with Susu-like products and gave millions of cedis to micro-scale enterprises to trade and work with.

“There are thousands of business people today who owe their beginning to the small loans they took from First National. Included in this number are tens of local contractors who were helped to secure and execute GETFund, cocoa roads and Road Fund contracts,” he said.

Strategic plan

Dr Nduom said the company developed a five-year strategy to be in 300 locations with one million customers.

“We designed ‘Money Stores’, ‘Express’ buildings and constructed them. We teamed up with a George Soros company that contributed capital to make this happen, so as not to fall on depositor funds.

“The huge investment of funds, energy and sweat was paid for by shareholders and was completed in July 2018. At our peak, we employed over 2,000 people, mostly very young men and women. Together with security guards and other service providers, our numbers exceeded 3,000,” he said.

The entrepreneur and business advisory expert said the company’s customer base exceeded 1.2 million and also made it possible for small businesses in places such as Widana, Djemeni, Kwame Danso, Walewale, Pusiga, Tumu, Paga, Debiso, Tuobodom, Anloga and many, many other towns where other licensed financial institutions would not go to get access to credit.

He said he had not invested so much time and energy and risked so much to establish and develop any company as he did with GN Savings.

“I was not an absentee shareholder. My job was to lead the business strategy development, fund raising and physical expansion. My body has felt the numerous and unending travels to Wulensi, Widana, Gwollu and many other places difficult to reach to find land and supervise construction,” he said.

He said his faith made him to believe “that soon, and very soon, justice will prevail. Then I will tell my story. The whole story about First National/GN Bank/GN Savings — the why, who and how”.

Source: graphic.com